What are Life Settlements?

Life

Settlements are a financial vehicle involving the discounted purchase of the

death benefits of life insurance policies of United States persons or Senior

citizens. The purchaser becomes the irrevocable beneficiary of a selected

policy or is contractually obligated to the death benefit under a selected

policy. Such vehicles offer a full face value fixed return paid by the specified

insurance company.

History

of Life Settlements?

Life

settlement transactions date back to over 100 years ago. Life settlements,

which are personal property, are the sale of a beneficiary's interest in a

life insurance policy in a secondary market. Just like American's can sell

their used property, they can sell also their life insurance policy. Owners

of life insurance policies may have determined they have excess life insurance

and desire to receive more than the cash surrender value by selling their

personal property (a life insurance policy) on the open market for a higher

cash value (the cash surrender value) than they would otherwise receive from

their insurance company.

After a long

history, this industry is evolving from an unknown asset class to a more recognized

one that is efficient and professionally guided. With the development of an

open market for life insurance policies, came the realization that the actuarial

value of a life insurance policy is greater than the corresponding cash surrender

value of a policy prior to the passing of the insured. A purchase of a portfolio

of these outstanding policies allows the beneficiary to forgo the ongoing

premium obligations and gain new found wealth for a policy previously considered

a liability. The new owner now has the full right to be the beneficiary of

the acquired policy. When the person named in the policy passes, the beneficiary

(the new owner), receives the policy benefit. Thus, a life settlement has

a contractual financial benefit attached to it which can be acquired and transferred

when purchasing a life insurance policy that has a medically determinable

life expectancy.

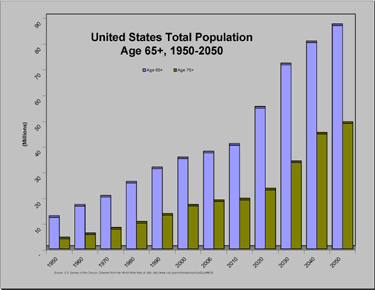

Policies purchased

are usually underwritten by an 'A-' rated or better life insurance company

which contracts to pay a benefit to the current owner's beneficiary. Policies

purchased by investors generally involve policies issued on the lives of individuals

with life expectancies greater than 2 years but less than 15 years, due to

term requirements of these potential investors.

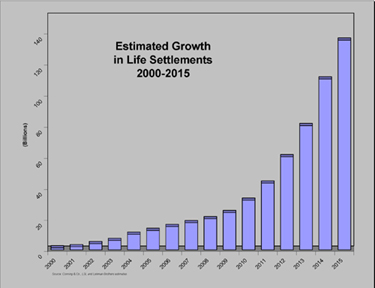

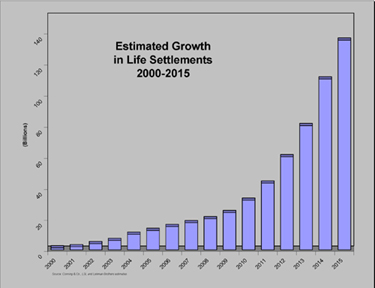

Studies on this

industry include: Conning & Co., an insurance industry researcher, who

estimated the potential size of the United States Life Settlement secondary

market to be in excess of $134 Billion, JE McGowan Consulting estimated the

potential secondary market to be greater than $18 billion dollars annually,

and the Senior Market Advisor, March 2002, article entitled "If life

settlements are good enough for Warren Buffett, shouldn't they be good enough

for everyone else?" stated that Mr. Warren Buffett is actively involved

in this industry.

Life Settlement Case Examples:

What

should people fully understand about Life Settlements?

There

are four issues that should be considered before investing in Life Settlements:

Liquidity, no monthly income, inexact maturities, and risk factors referenced

in an offering memorandum (if available).

-

Once a

Life Settlement is purchased, the owner must wait until maturity or resell

a Life Settlement (if possible) to receive any monies from that policy.

-

There is

no "guaranteed" monthly or annual income derived from Life Settlements.

-

Life expectancy

underwriting is not an exact science; therefore, a Life Settlement could

mature before or beyond the anticipated term.

-

Risk Factors

are associated with Life Settlement investments therefore please fully

review all documentation before considering an investment.

Why Choose

Life Settlements?

Few financial

products in the marketplace today offer the potential returns a life settlement

may provide. Life settlements typically avoid capital market volatility and

global market increases and decreases unlike traditional stocks, bonds, mutual

funds, GIC’s, etc. Life settlements may provide both flexibility and

security.

To diversify

a portfolio, investors have noted they are considering adding investments

that generally do not react in the same way to capital market fluctuations

and which are not typically tied to interest rate fluctuations. Life settlements

typically allow one to diversify and generate positive returns with collateral

security.

What

about safety?

Usually when

Life Settlements are purchased the insurance policies are underwritten by

insurance companies rated "A-" rated or higher (excellent) by A.M.

Best (or its industry equivalent). Thus, your principal and return are supported

by the insurance company's assets. Upon policy maturity, returns are sent

directly to the beneficiary (or their trustee) by the insurance company. At

policy maturity, principal plus profit is to be "paid in full" and

is a legal right protected by law.

The

Life Settlement Industry